Groww is an Indian investment app. Nowadays, most of us know about this app. In this article, I will tell you ‘how to invest in Groww App in 2024. I hope this article helps beginner investors like you. So, let’s read.

I started using the Groww app when it started for the first time in India. The Groww app was launched in India in May 2017. But at that time I don’t know about the Stock Market, Mutual Funds, Equity, Debt or investments. I started using the Groww App, just because it was providing ₹100 cashback for joining a new friend. And it still does the same.

During lockdown when I started creating content on my blog aggressively I learned a lot of new things just to write down it on my blog. And investing money is one of them. Luckily I had a Groww Demat Account. So, I started exploring it and today I am a regular investor of this app along with some other leading investment apps.

Also Read: Upstox vs Groww: Which is better?

Groww App

Anyone with age 18 or above is eligible to invest their money in Stocks, Mutual Funds, IPO or Sovereign Gold Bond through the Groww App. But in order to invest your money in Groww App, first you need a Demat Account in this app. The process is very simple. But till will take a few days to complete the process (maybe 48 hours or 2 business days).

Groww App is the simplest and easy-to-understand investment app I have ever used. Also, the most attractive features of this app are its referral offer, no AMC charges and simple interface. Recently, they have added UPI recharge, and bill payment options to their platform too. Now if you wish you can pay your daily essential bills using this app also. So, no need to install multiple apps for different work. You can do a couple of things in one app called Groww.

Also Read: Best Mutual Funds in India

How To Open a Demat Account in Groww App?

If you want to open a Demat account and invest in Groww App then you need a few basic documents of you. The documents are PAN Card, Aadhar Card, Photo, Signature, Cancelled Cheque etc. Now let’s follow the below process.

- First download the Groww App.

- Click on the option ‘Open Demat Account’.

- Fill out the form and submit it.

- Enter OTP.

- Share your PAN Card and Bank Account details.

- Complete the E-KYC process.

That’s it!! Now it will take 2 business days to complete your application. Once they finish your application either your account will be ready or if anything is missing or error then they will ask you to resubmit the application.

Also Read: Best FMCG Stocks in India

How To Invest in Groww App

You can invest your money through Groww App in many options. The investment options available on the Groww App are as follows Stocks, Mutual Funds, SGB etc. I invested my money in Stocks and Mutual Funds on this app. And on another app, I have invested in all three options.

Invest in Stocks Through Groww App

To invest your money in Stock Market, you need a Demat Account and a Trading Account. The Demat Account helps you to store all your Stocks whereas the Trading Account helps you to buy and sell the Stocks. Also, keep in mind that when you are going to invest for the first time in Stock Market, you will see a lot of options like BSE, NSE, Delivery, Intraday etc.

The simple meaning of BSE and NSE are Bombay Stock Exchange and National Stock Exchange respectively. And, if you want to buy stocks for a longer period then you have to choose the Delivery option and for buying and selling in one day, the Intraday option.

Before going to invest money in Stock Market, you need money in your Groww balance. So, first, add money and then buy shares through Groww App.

Also Read: Best Trading Apps in India

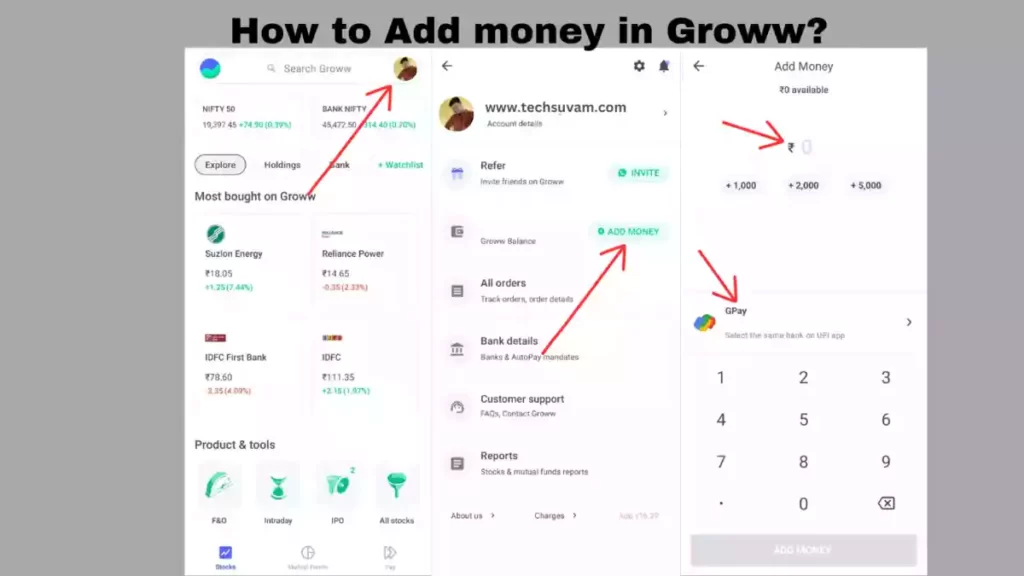

Add Money in Groww Balance

Whether you want to buy stocks or invest in Groww App, you need balance in your Groww wallet. Groww App runs a refer and earn program. There you can earn ₹100 for every new referral. This money can be used to buy stocks or invest in mutual funds. Or else, you can withdraw it to your Bank account too. Now let’s read how to add money to Groww balance.

- First, tap on your profile picture.

- Now choose the ‘+Add Money’ option.

- Tap on the ‘Add Money’ option.

- Enter the amount and make payment.

- The two payment methods are UPI and Net Banking.

Also Read: Daily 1000 Rupees Earning Apps

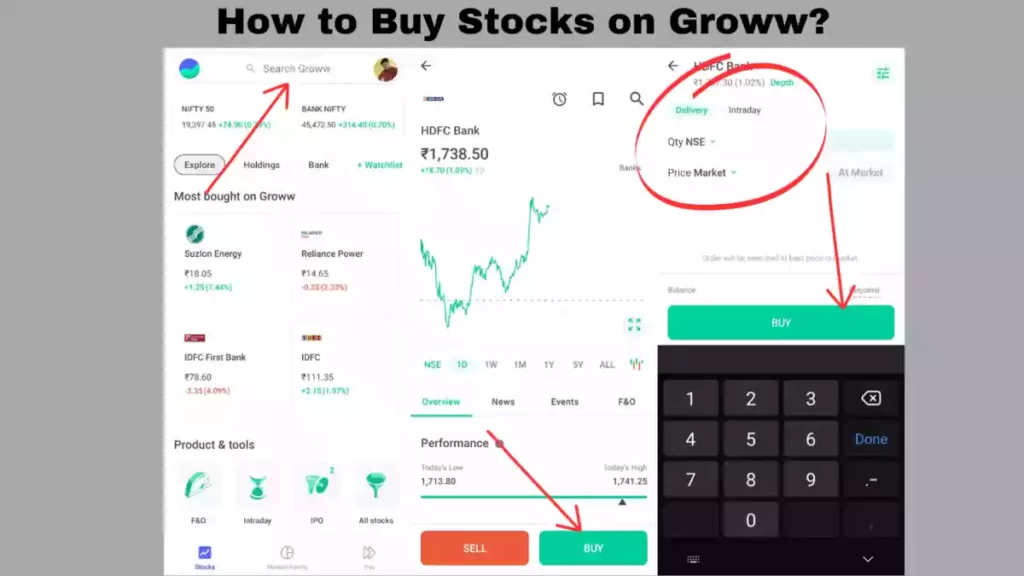

How To Invest in Stocks Through Groww App

- First, open the Groww App.

- Enter 4-digit Passcode.

- Search or select any Stock that you want to buy.

- Now choose the option ‘Buy’.

- Select Delivery or Intraday, Price Market or Limit and NSE or BSE.

- Enter quantity and choose the option ‘Buy’

- Please note that, if you don’t have the required balance in your wallet then you need to add money first.

- Once you tap on the ‘Buy’ option, the Stock will start reflecting on your Groww App Portfolio.

Invest in Mutual Funds Through Groww App

A lot of people say Mutual Funds are the safest option than Stocks. Whatever it is, I am not here to give you any financial advice. Through Groww App, you can invest in varieties of Mutual Fund options like High Return, Tax Saving, Large Cap, Mid Cap, Small Cap Mutual Funds etc.

When you proceed for the first time to invest your money in Mutual Funds, you will see two options such as One Time and Start SIP. Now what does the SIP mean? Ok, let me be clear. The meaning of SIP is Systematic Investment Plan. It means you can invest a fixed amount (which you can increase or decrease anytime) for a longer period of time on a fixed date.

The majority of Mutual Funds providers provide Mutual Fund investments for as low as ₹100, ₹500 or ₹1000 for SIP and ₹500 to ₹5000 for one-time.

How To Invest in Mutual Funds Through Groww App

- First of all, open the Groww App.

- Select the Fund or search it.

- Choose ‘One-Time’ or ‘Start-SIP’.

- Enter the investment amount.

- Pay from your UPI or Net Banking.

- Select Auto SIP and Setup Bank details for SIP.

Mutual Funds will take up to 2 days to reflect on your Groww App Dashboard section. You can redeem your funds, invest more amount, change your SIP amount or check Fund details anytime from the investment details option.

Also Read: Paytm Money Review

FAQs: Invest in Groww App

It’s very easy to use an app like Groww. It is an investment app that’s why many people feel uncomfortable using it. But if you want to invest in Groww App then I don’t think there is any better investment app in the market than Groww for beginners in India.

You can withdraw your money from your Groww balance easily. To do this, first tap on the Groww balance section. There you will see the available balance and Withdraw option. All your saved Bank accounts will be displayed below. Choose the Bank account where you want to withdraw your balance and enter the balance or tap on the ‘Withdraw All’ check box.

From Groww App or IND Money App, you can invest in US Stocks from India.

There are two payment options available on the Groww app such as UPI and Net Banking. During buying stocks or investing in mutual funds you will see the option payment through UPI. If this option is not showing then first link your UPI there and make payments via UPI.

Final Thoughts

I don’t know who are you, what your age is or whether you are a beginner or pro-investor. Whatever it is, in today’s article I tried to show how you can invest your money in Groww App. I am sure this article helps you to understand more about the Groww App in a better way. Please be careful before buying and selling any stocks or investing in any mutual funds. No matter how many days it takes to understand a particular fund or stock, it’s ok. But don’t invest blindly. This is my opinion.

So, I hope you read this article till the end. If you found anything wrong then don’t hesitate to tell me about it. I will definitely try to sort out this as soon as possible. Take care of yourself, will see you in another article.

Also Read: How To Delete Groww Account Permanently